Introduction

The 2017 Annual Accounts Act was adopted in September 2017 and promulgated on October 5, 2017 in the Official Gazette of the Republic of Suriname, number 84. This law came into effect on October 6, 2018 and obliges public limited companies and the other entities referred to in this law to prepare annual accounts. The Annual Accounts Act also prescribes the reporting standards according to which the annual accounts must be drawn up. Depending on the size and type of the company, the Annual Accounts Act prescribes a specific reporting standard. The Annual Accounts Act distinguishes organizations of public interest and divides legal entities into three categories: large, medium and small legal entities.

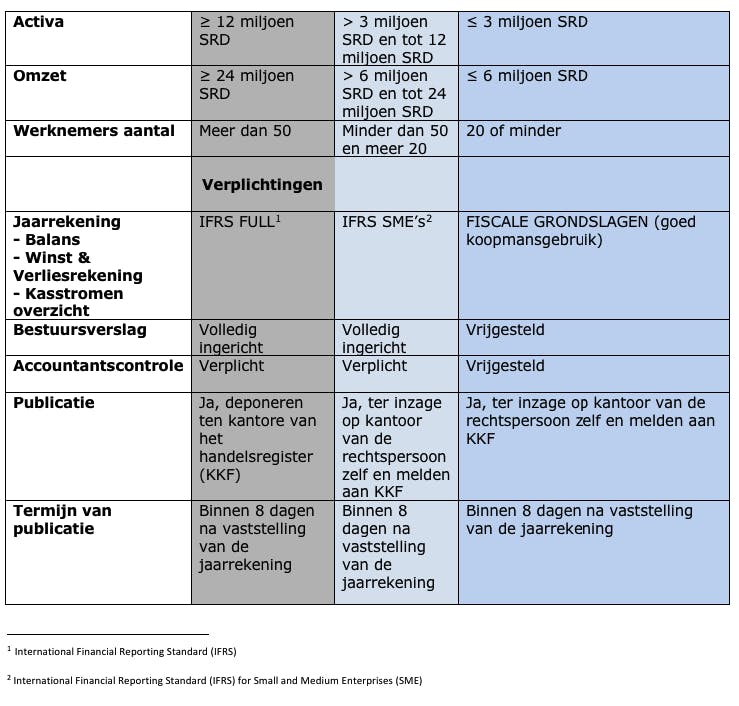

When is a legal entity large, medium or small?

The Annual Accounts Act includes criteria on the basis of which a legal entity falls into one of the categories listed here. The overview below contains the criteria on the basis of which, according to the Annual Accounts Act, an assessment must be made in which category the legal entity falls. A number of important obligations for legal entities are also included in the overview.

Overview

The assessment must be made on the basis of two consecutive balance sheet dates and the legal entity must meet at least two of the three criteria listed in the overview to fall into a particular category.

When do the criteria apply and when do the prescribed reporting standards apply?

Size criteria apply from January 1, 2018. So from this moment on, it must be assessed in which category the legal entity falls. For large legal entities, the annual accounts for 2020 and for medium and small legal entities, the annual accounts for 2021 must be drawn up in accordance with Annual Accounts Act.

In this memo, I will only discuss a few obligations for legal entities, which the Annual Accounts Act entails for these legal entities, in order to subsequently examine what IFRS (IAS (International Accounting Standard) 19 Employee benefits and IAS 24 Disclosure of related parties) entails in relation to the fiscal financial statements.

Tax principles versus IFRS

The taxable profit is calculated in accordance with good business practice, with due observance of a consistent line of conduct, which is independent of the likely outcome and which can only be changed if special circumstances justify this. What is a system that complies with good business practice? That is a system that is based on what business economics teaches about the correct way of determining profit. However, the result of this business economics teaching may not conflict with the tax law or be contrary to the general scheme or principle of the tax law. The doctrine of good commercial practice has been completed by case law and practice and therefore has its own (fiscal) interpretation. For example, good merchant practice permits the valuation of certain assets at historical cost / acquisition price, while business economics assumes a valuation at current value. See an important difference there. Over the years, the concept of good business practice has deviated in many respects from the prevailing business economic systems.

IFRS is a reporting standard that aims to limit the differences between different standards by harmonizing regulations, standards for financial reporting and procedures relating to the preparation and presentation of the financial statements. The International Accounting Standards Committee is tasked with preparing these standards and believes that harmonization is best pursued by focusing on the financial statements, which are prepared for the purpose of providing information useful in taking of economic decisions. To achieve this harmonization, the IASC (International Accounting Standards Committee) has established many rules (standards) for the preparation and presentation of annual accounts. These rules form a system of their own for calculating profits and differ in many respects from good business practice.

Suriname has adopted the IFRS regulations with the adoption of the Annual Accounts Act. For legal entities - this in contrast to sole proprietorships, because the Annual Accounts Act does not apply to this group - this means that if they are obliged to prepare their annual accounts in accordance with IFRS, they must also prepare fiscal annual accounts for their annual profit in accordance with the Income Tax Act 1922. to calculate.

Employee benefits IAS 19 (revised 2011) and IAS 24 Related party disclosures.

IAS 19 prescribes how employee benefits must be accounted for and what information must be disclosed in this regard.

The standard requires that an entity:

- Is a liability when an employee has rendered service in exchange for employee benefits that are due in the future; and

- Recognizes an expense when the entity uses the economic benefit resulting from service rendered by employees in exchange for employee benefits.

Employee benefits include:

- Short-term employee benefits, if they are expected to be fully settled within twelve months after the end of the annual reporting period in which the employees have rendered the related service. This includes wages, salaries, social security contributions, holiday pay, continued payment in the event of illness, profit sharing, bonuses and benefits in kind.

- Post-employment benefits, such as pensions, life insurance and medical care.

- Long-term employee benefits, such as long-service or sabbatical leave, anniversary benefits, other benefits associated with long-term employment, long-term disability benefits.

- Severance pay.

For the purposes of disclosure, this Standard requires an entity to disclose the amount recognized as an expense for defined contribution plans, such as retirement benefits, and when required by IAS 24, an entity discloses information about contributions to defined contribution plans for key management personnel. This also provides rules about the method of valuation and performance.

IAS 24 prescribes information requirements about transactions with related parties. In this regard, it is required that an entity discloses remuneration for key management in aggregate and broken down into the following categories:

- short-term employee benefits;

- post-employment benefits;

- other long-term employee benefits;

- termination benefits; and

- share-based payments.

In this context, it would go too far to deal extensively with IAS 19 and IAS 24. Therefore, I will suffice with the foregoing.

Good merchant practice.

Nothing will change as regards the method of valuing employee benefits based on good business practice. At the time of payment, making available, becoming interest-bearing or collecting collectable benefits, this is an expense for the entity. Good commercial practice permits a provision to be formed for pension contributions and post-employment health care costs. The additions to these provisions are charged to the result in the year in which the entitlements are accrued and the provision is used to make payments of these benefits or the provision is released when the entity's obligation to make payments expires.

In certain cases, employee benefits will have to be capitalized if they arose in the year of reporting, but have not yet been paid. These payments are charged to the result in the year in which they were created.

Good business practice does not require disclosure. After all, the rules of good business practice aim at calculating the profit according to fiscally acceptable principles and rules. IFRS serves a different purpose and therefore requires proper disclosure.

Finally

Depending on the way in which the financial statements are prepared and how the IFRS rules are applied, each entity will have to assess how far they should go with the disclosure. This will have little or no impact on the fiscal annual accounts.

Do you want to know more? Please contact us. We are happy to serve you!