On Monday May 11, 2020 the Minister of Finance announced a number of fiscal support measures. In an announcement of April 9, 2020 the tax authorities had already published some tax measures that the Minister of Finance has implemented on its social media platform. Below is an overview of the measures.

Measures April 9, 2020

- SAS IB Tax returns

- For both limited liability companies and natural persons, the SAS IB tax returns are moved with new submission deadlines.

- Provisional tax return 2020 not later than 15 June 2020.

- Final tax return 2019 as of / not later than 30 June 2020. - Terms of payment for SAS IB

- Final tax return as of June 30, 2020.

- Provisional tax return 2020.1st term 15 June 2020 and other terms remain in effect (15 July / 15 October /31 December). - Payment arrangement

Taxpayers can send a letter to the Recipient of Direct Taxes with the request to qualify for a payment arrangement. It must be substantiated and proved that the taxpayer is in liquidity problems as a result of the Covid-19 crisis. - SAS (HUBA) Assistance with tax return

SAS-HUBA (Help with completing Tax returns) will be postponed to the period June 1 to June 30, 2020. - Wage tax and sales tax returns

The tax return is submitted in accordance with the established legal deadline (16th of the month). Under certain conditions, the Tax and Customs Administration will be flexible in some cases. Eligible for this are: “taxpayers who request a declaration and payment for the period March, April, May and June 2020 in the context of turnover tax and wage tax.” - Fine and interest

No penalty and interest will be charged for Income Tax until the new filing date.

Measures May 11, 2020

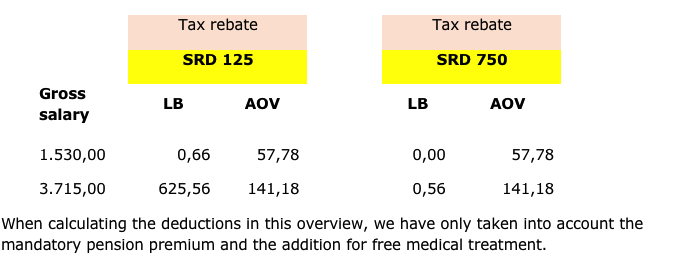

- Tax credit for tax returns, expand from SRD 125 to SRD 750 per month.

- Postponement of Income tax return.

- Smooth payment schedule.

- HUBA (Help with completing Tax returns) rescheduled to June 15, 2020 and can be rescheduled further if required.

- Payroll and sales tax:

Flexible attitude towards taxpayers who request a postponement of returns and payment in the context of turnover tax and wage tax for the period March, April, May and June 2020. - Penalty and Interest:

No penalty and interest will be charged for income tax until the new filing date.

These regulations apply to companies registered with the tax authorities. If you have any questions, please contact number 477222 of the tax authorities.

We have the measures announced on May 11, 2020 from the media. We have not seen official publication by means of, for example, a decision, state decision or other channels customary for these types of matters, at least as far as we have been able to ascertain, they have not been published.

In anticipation of any official announcement, we have raised the following questions and / or the following comments:

- What is a smooth lineup and what is a smooth payment schedule? Does it mean that requests in this context are automatically honored?

- Most of the measures of 11 May 2020 had already been implemented on 9 April 2020. Compare for yourself.

- When does the increase of the tax credit formally take effect and until when does this rule apply (we have heard from other sources that it applies for 6 months).

- Why has no arrangement been made for the so-called Article 42C.

- Petitions, where it is now compulsory to declare a lower calculated tax 2020 compared to 2018?

- Will assessments with fines follow to taxpayers who declare a lower amount in the provisional income tax return 2020?

- How should a taxpayer who has already submitted a provisional income tax return deal with the increase in the tax credit? Can he now set off the excess tax against the outstanding installments or must he request a refund?

- Measures of April 9, 2020 only apply to companies that are known to the tax authorities and the measures of May 11, 2020 apply to everyone, right?

- Discount has been granted to natural persons. An entrepreneur who has his business in a limited liability company does not receive a discount, but his colleague who has almost the same business in the form of a sole proprietorship does. Why a distinction?

- Why not take measures in the wage tax sphere, especially for companies that are not closed or partially closed because of the Covid-19 crisis, but who continue to pay staff?

- What procedures must we follow and what criteria apply when assessing requests for deferment of payment or similar?

- The higher the salary, the higher the discount. With a wage of:

With this newsletter we hope that we have been able to inform you somewhat. For questions or comments you can of course always call or e-mail us. We hope that we will also receive an answer to our questions quickly and welcome any measure that can make life a little more pleasant.